SoFi's national bank charter widens door for fintechs

Navigating the New Canadian Derivatives Landscape: Key Changes and Compliance Steps for 2025

Getting an Edge with Services: Driving optimization by embracing technological innovation

Banking Essentials Newsletter: August 21st Edition

The Four Steps of Effective Due Diligence

A view of SoFi Stadium on Aug. 27, 2020, in Inglewood, Calif.

Source: Joe Scarnici/Getty Images News via Getty Images

The Office of the Comptroller of the Currency's decision to grant a national charter to SoFi Technologies Inc. marks a widening opportunity for financial technology companies that want to become banks, industry and policy experts told S&P Global Market Intelligence.

The challenges of obtaining these charters may discourage smaller banks from seeking them.

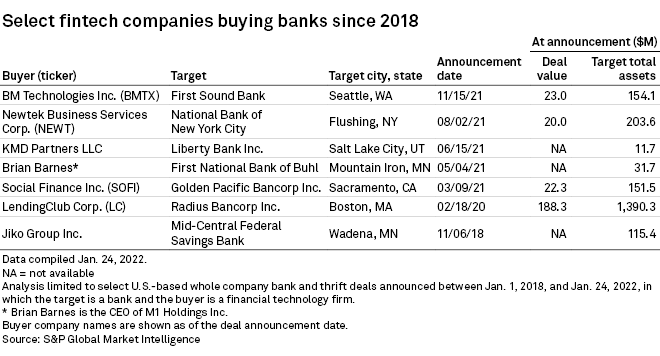

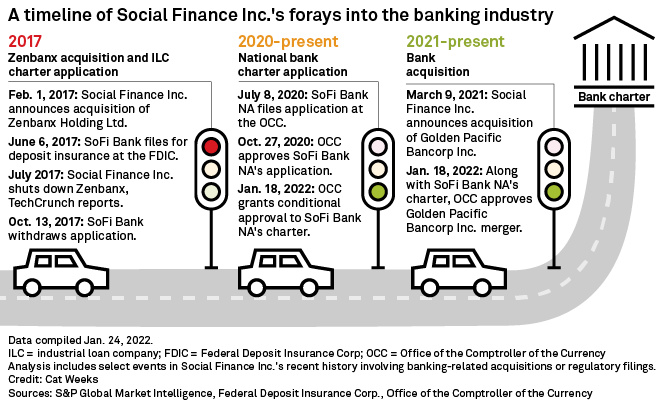

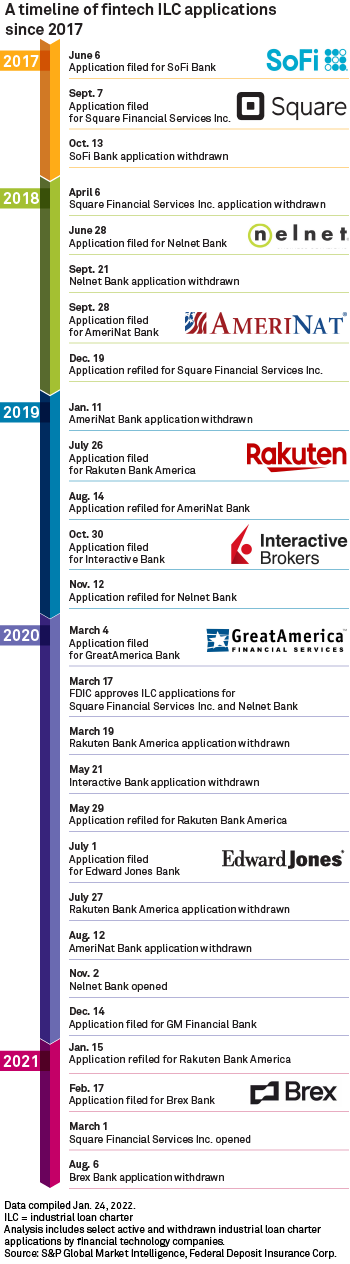

SoFi achieved its bank charter from the Office of the Comptroller of the Currency largely through its acquisition of then-Golden Pacific Bancorp, completed Feb. 2 . That concluded a journey that started in 2017 with an application for an industrial loan company charter with the Federal Deposit Insurance Corp., a subsequent withdrawal and its 2020 application for a national bank charter . SoFi also got approval from the Federal Reserve to become a bank holding company.

The OCC's decision on SoFi signals a renewed message that "If you're willing to go that traditional route, I think the door is open," said Jonah Crane, partner and financial adviser to fintech companies at Klaros Group, in an interview. "This is definitely a good sign from the perspective of, 'Can fintechs become banks? Can fintechs acquire banks?'" Crane said.

Seeking path forward

Some large fintechs want to become banks because it gives them access to more customers and allows them to provide the same broad range of services that national banks do. LendingClub Corp. , another large fintech, has also secured a bank charter through an acquisition.

The decision is significant, given strong indications by acting Comptroller Michael Hsu that bank charters for fintechs are under a powerful microscope, Crane said. Among other public actions, Hsu told the American Fintech Council in November 2021 that "We need to remove the disparity between the rights and obligations of banks and the rights and obligations of synthetic banking providers by holding SBPs to banking standards."

Under the Trump administration, federal bank regulators were open to granting charters to fintech companies. But following the election of U.S. President Joe Biden, the agencies promised to be far more scrupulous when examining applications.

The SoFi approval shows that the issue is not a complete nonstarter for the Biden administration.

SoFi's experience "could be a model for a small number of large fintechs" that want to compete with banks on a national scale, said Ian Katz, managing director of bank consultancy Capital Alpha Partners LLC.

Despite the OCC's decision, the route to a charter for technology companies will continue to be challenging, according to Sam Kilmer, who leads the fintech advisory practice at Cornerstone Advisors .

It is likely that the company would need to have broad recognition in the industry and perform many of the functions of a bank, as SoFi did in its loan offerings, Kilmer said.

"The benefit of an OCC charter or any bank charter is one more indication of broad acceptance and utility," Kilmer told S&P Global Market Intelligence. "I don't think someone gets a charter unless there's a perception of utility."

Fintech challenges

Given the long list of compliance requirements, smaller and midsize fintechs may not seek a national charter, policy experts said.

"I don't believe most fintech companies are likely to go down the path of a full bank charter, but rather look for technology-enabled financial institutions that can provide them the ability to continue their growth within a regulatory structure," said Phillip Goldfeder, head of public affairs for Cross River, a technology infrastructure company that helps fintechs operate in the financial services sector.

Under the agreement, SoFi must fulfill a brand-new requirement that toughens its participation in cryptocurrency activities — a rule that many fintechs are watching closely.

The financial institution must get a written nonobjection from OCC supervisors before it can take part in any crypto actions, including the ones it is doing currently and in the future. This tightens the requirement the agency set out in November 2021, when it issued an interpretive letter calling for OCC approval going forward for three specific activities, including cryptocurrency custody services, holding deposits in reserve for stablecoins and using crypto technologies such as stablecoins for payments.

The crackdown on crypto indicates that fintechs that are predicated solely on the exchange of crypto assets and provision of crypto services may struggle to secure a bank charter.

But firms where crypto is simply part of a broader, diversified offering may simply need to demonstrate a clear segregation [of crypto and more traditional] assets to ensure safety and soundness, according to Bryce VanDiver, a partner at Capco, a global business and technology consultancy.

"In short, the signal is 'tread with caution' as we are fully reviewing crypto's role as an asset class in the banking system," VanDiver said.

Among other requirements, SoFi must also be capitalized at $750 million to start out, and must establish a written operating agreement.

Another challenge will be compliance with the Community Reinvestment Act, which requires banks to demonstrate that they are providing services to low-income and minority communities.

"If you're a bank and you have to comply with the CRA, that's work," Katz said. "It's regulations, it's something you need a group of people paying attention to."

There will also be numerous other reports and examinations from the OCC, and, as a bank holding company, SoFi will "have the [Federal Reserve] in your shop asking questions. It's more the level of scrutiny that you get at the ground level from the regulators," Katz said.

Banking industry applauds

The banking industry welcomed the OCC's decision to bring SoFi under the federal regulatory regime.

"We are pleased to see the growing trend of fintechs looking to become banks," said Rob Morgan, senior vice president, innovation and strategy at the American Bankers Association, in a statement to S&P Global Market Intelligence. "It is important that consumers receive consistent treatment wherever they go for their financial services and the bank regulatory framework ensures that important protections are being evenly applied."

The Bank Policy Institute and the Consumer Bankers Association also lauded the move.

"We commend SoFi for assuming the broad oversight requirements of a federally chartered financial institution, including safety-and-soundness regulation and supervision by federal prudential regulators," Consumer Bankers Association President and CEO Richard Hunt said in a statement.